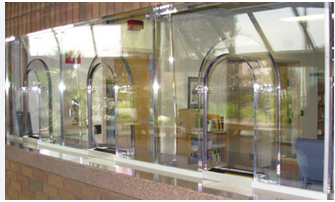

With regards to business banking, the teller windows is a vital section of the procedure. Clients depend on tellers to handle their purchases, and banking companies depend upon successful tellers to have their teller windows operations working efficiently. But exactly what makes the teller home window this kind of essential part of a bank’s success? In this post, we’ll investigate the significance of effectiveness in the teller windowpane and how banking institutions can improve their teller method.

Streamlining the Financial transaction Procedure: In terms of handling purchases, velocity and precision are crucial. Customers have to get out and in in the banking institution quickly because of their deals accomplished effectively. Banks that optimize their teller windowpane operations provides faster company to their potential customers, minimizing wait instances, and boosting overall customer care. By streamlining the deal process, tellers can assist a lot more consumers and move facial lines faster.

Electronic Improvement: As modern technology consistently advance, banks are looking for ways to digitize their processes and minimize the reliance upon papers-centered transactions. Implementing electronic digital solutions like income recyclers, digital signatures, and programmed teller models will help decrease cash dealing with and enhance all round efficiency. These options can also release tellers’ some time and allow them to give attention to more technical buyer requirements, such as monetary assistance and consultation.

Coaching and Assistance: To optimize efficiency at the teller home window, it’s vital to have well-skilled tellers. Teller training should deal with everything from financial transaction handling to customer support abilities. Financial institutions must also offer tellers with on-going support, including mentoring and performance responses, to help them enhance their skills and stay interested. A highly-trained and encouraged teller team can handle substantial volumes of dealings effectively.

Customer Service: The teller window is truly the initially point of speak to from a lender along with its consumers. Therefore, it’s crucial to provide exceptional customer care at all times. This includes anything from greeting buyers using a grin to dealing with deals effectively and precisely. Banks that prioritize customer service with the teller window will create stronger partnerships with their clients, boosting retention and loyalty.

Info and Statistics: Banking institutions get access to huge amounts of details, and using that data can help improve the teller window process. By tracking deal amounts, wait around occasions, and teller overall performance, banks can determine bottlenecks and locations for development. Using this info, banking institutions can adapt staffing degrees, coaching applications, and technological innovation answers to enhance efficiency with the teller home window.

Simply speaking:

The teller window may seem like a small section of the banking procedure, but it has a vital role in the general success of the banking institution. By refining the teller windowpane method through streamlining purchases, digital improvement, staff training, customer care concentrate, and information stats tracking can lead to increased customer care, elevated financial transaction amount, and eventually, a booming consumer banking enterprise. Banks that prioritize efficiency with the teller home window will probably be better placed to weather conditions any hard storms which may arrive their way in the future.